CRIMES AGAINST HUMANITY TOUR! MRNA “vaccines” will kill millions. Dr Judy Mikovits & other Doctors explain what Dr Fauci etc have been doing.

https://rumble.com/embed/vwlj9f/?pub=h1fn1

Dr Mike Yeadon sends a warning to the World about mrna “vaccines”. Genocide!

https://www.bitchute.com/video/n8Bq7jBzN14K/ Dr Mike Yeadon exposes the corruption with everything covid. Nuremberg2 for all pushing these gene therapy drugs ASAP!!!

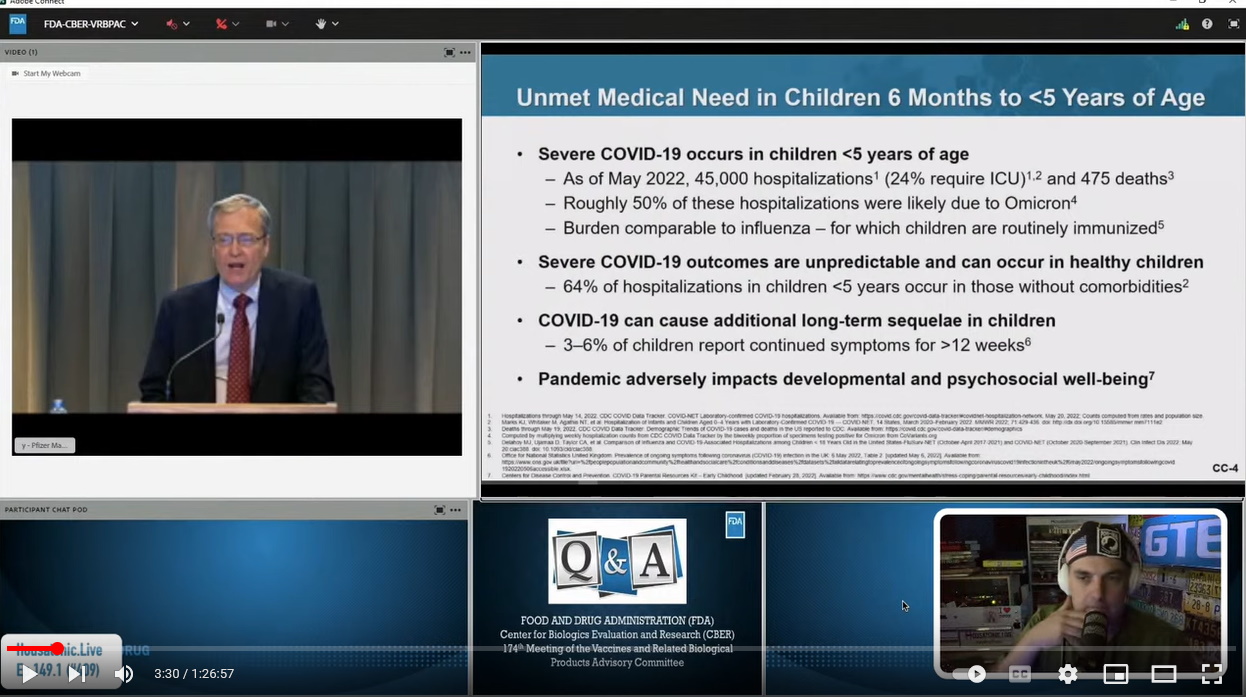

Housatonic Live Shines The Light on MRNA & Demons That Push It.

Housatonic Live Exposes MRNA Fraud https://youtube.com/watch?v=3smRcL7ovXA Click link above to watch this amazing video. Bravo!!! "We don't have a complete understanding of the FULL nature...

The Man Who Found Hunter Biden’s Laptop Interview with Will Cain

The Guy Who Found Hunter Bidens Laptop Interview

“Then They Came For The Canadians” Event

Click on the link below to watch the 5+ hour conference! Amazing testimony exposing the crimes against humanity by our governments and institutions. Nuremberg2 ASAP!!!...

MRNA, AIDS, Vaccines, 5G, Marburg Hemorrhagic Fever explained by Todd Callender interview with Dr Reiner Fuellmich!!! Explosive testimony!

MRNA, AIDS, Vaccines, 5G, Marburg Hemorrhagic Fever explained by Todd Callender interview with Dr Reiner Fuellmich!!! Explosive testimony!

10 held by H for the big guy?

10 held by H for the big guy?! Hunter Biden laptop email database. Here is a link to the actual email that appears to be...

Canadian Veteran Jeremy MacKenzie explains his Diagolon joke Country that crazy liberals think is REAL?!?!

https://www.diagolon.org/index.html

Live With Raging Dissident – Jeremy MacKenzie, known as Raging Dissident, shares stories of the Freedom Convoy in Ottawa, being censored on multiple social media sites, Veterans For Freedom, inventing a fake country called Diagolon that became a national security threat and more. https://ragingdissident.com/

https://www.facebook.com/plugins/video.php?height=314&href=https%3A%2F%2Fwww.facebook.com%2FLivefromtheshed%2Fvideos%2F531826971888607%2F&show_text=false&width=560&t=0 Great explanation by Jeremy MacKenzie of what he has been doing mocking criminal liberals. The liberal IDIOTS think he is the LEADER of DIAGOLON....

Crimes Against Humanity – Dr. Reiner Fuellmich In-Depth Interview – May 9 2022

https://www.bitchute.com/video/Gw3wvGVumAPX/ CHDTV Exclusive: Crimes Against Humanity – Dr. Reiner Fuellmich In-Depth Interview will go live on this page on May 09, 2022 at 06:00 pm

1000’s of the World’s leading physicians & scientists are analysing the Covid injections & have determined Crimes Against Humanity!!! Nuremberg2 ASAP!!!

https://www.bitchute.com/video/Ttok1SHKDNch/